Global View Investment Blog

The Truth About Rising Rates and Bond Prices

Bonds (and bond indexes filled with bonds with long maturities) lose money when rates rise.

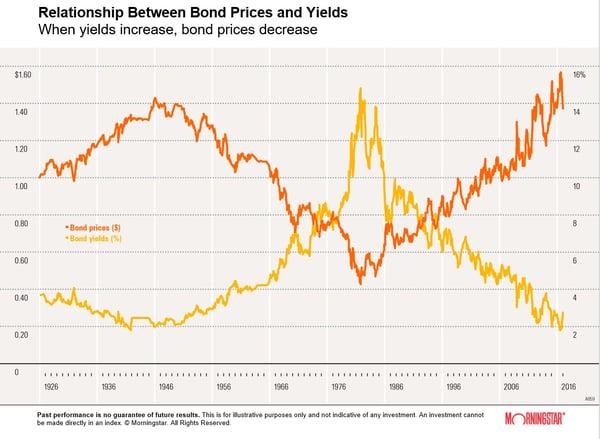

The prices of bonds rise when interest rates fall. This is what happened from the early 1980s to late 2016.

But for many reasons, many experts believe we are now in a period where interest rates will rise. When interest rates rise, the prices of bonds fall.

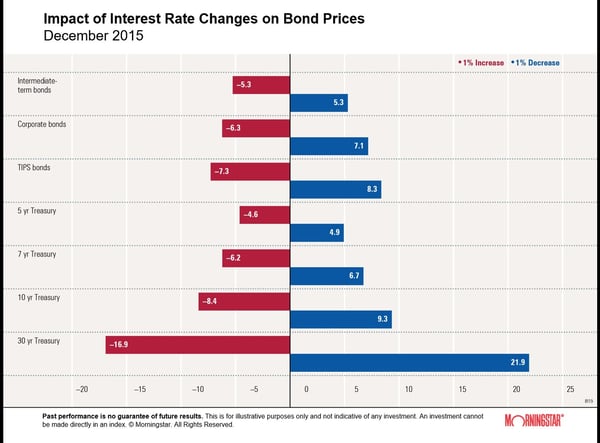

The longer the maturity (really duration – it’s a technical term) of the bonds, the more the prices fall.

For example, when interest rates rise 1 percent, investors should expect to lose about 8.4 percent in the 10-year treasury and 6.3 percent in corporate bonds. Investors in 30-year treasuries would lose about 17 percent for every 1 percent interest rates rise. While most investors wouldn’t buy 30-year treasuries, because they are issued, they go into the bond aggregate index. And because most bond managers benchmark to this index, they will buy more of these.

If you believe, as smart bond buyers do, that interest rates may be rising for a long time, it is important to understand the relationship between rising rates and bond prices, as shown below.

In this chart, rates were falling since the early 1980s. It seems likely that rates will rise from this point, more like the post-World War II period. A reasonable question to ask is how quickly they will rise and how this will affect the prices of long maturity bonds and the bond index funds.

Ask yourself: If investors made a little more than 3 percent per year in a bond bull market, what might their returns be in a bond bear market?

The bonds likely to have the lowest returns are exactly what most bond owners are buying.

The U.S. is currently running high deficits and is expected to issue $1 trillion in net debt to the public in 2018. That’s 50 percent higher than last year. It means more long-term treasuries are being issued than before. And someone has to buy them.

Banks have increased their treasury holdings from $212 billion in 2012 to $479 billion in 2017. The liquidity-coverage ratio (and other regulations) especially played a role. Because equity valuations are high, pension funds and other players have been moving more funds into the bond index, which is highly weighted in treasuries (42 percent treasuries, 28 percent agency mortgage backed securities and 25 percent investment grade corporate bonds).

Moreover, the tax cuts caused budget deficits (at least temporarily) to rise. This means the U.S. government is issuing more and more long-duration treasuries (with the most interest rate risk). These are the bonds banks are buying, and because they become more important as a piece of the bond index, index mutual funds buy increasingly more and more.

Pimco, a bond fund manager, has created an exchange traded fund Bond. Bond, unlike the traditional bond indexes, weights exposure to different sectors based on Pimco’s evaluation of the opportunity. Whereas the traditional bond index is 42 percent treasury bonds (and rising), Bond only has an allocation of about 10 percent to treasury bonds.

In other words, if you think about it, the last bonds you would buy (at least on a medium- to long-term basis) are treasuries. But if you are buying a bond index, that is exactly what you are doing.

To Make Money, Think Differently Than the Guys Who Don’t Want to Make Money

Now that we have established the fact that it doesn’t make sense to buy bonds that are likely to fall in price, what do you do?

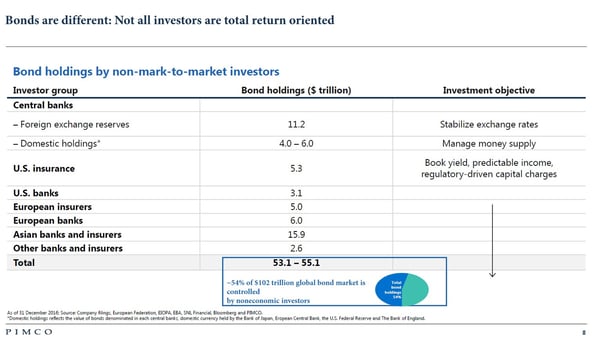

Before I visited Pimco in New York, I didn’t know that 80 percent of bond buyers beat the index. I didn’t know the degree to which banks and insurance companies are forced to buy bonds they know are unlikely to produce solid returns.

Morningstar Direct data shows that, for the five years ending 2016, more than 80 percent of intermediate bond managers and 80 percent of high yield bond managers beat the bond index, after fees. In fact, all bond categories beat the index over five- and 10-year periods.

During my visit to New York, in the New York Stock Exchange building (they have great presentation rooms), I gained a better understanding of how bond managers do it. They often get something they call the “complexity premium.” Because it’s hard for other managers to understand and structure (often due to rules that prevent them from making money), simply looking at the deal from the perspective of making money seems to work well.

Complexity premium? I hate using jargon, but I’m going to go ahead and create a new one – the stupidity discount. Bonds are discounted due to rules causing the banks and insurance companies to own them that would never make sense to a less “complicated” investor!

At this moment in time, a lot of bonds with a “complexity premium” are mortgage bonds, collateral backed credit and emerging markets bonds.

To learn more about how we construct portfolios (and pick bonds), click here.

Boring Charts (For Folks Like Me to Look At)

Here’s a better explanation of why central banks, commercial banks and insurance companies are not expressly trying to make money.

Central banks issue bonds to provide liquidity (money), not to make money. Commercial banks are often forced to sell bonds due to stringent government regulations. For example, they were forced to sell residential mortgages rated below investment grade years ago, which are not investment grade but not re-rated. This is a key area where they make money. Similarly, insurance companies buy bonds to match assets to liabilities (to have money when claims are expected to come due). Both commercial banks and insurance companies are often forced to sell bonds when a rating changes. This all creates opportunity for enterprising bond investors.

A Better Explanation of Interest Rate Risk

The exposure you have to interest rate risk depends on a bonds “duration.” Duration depends on two variables. The longer the maturity, the longer the duration. And the higher the coupon, the shorter the duration. Basically, a rise in interest rates impacts the price of a bond based on its duration. As illustrated in the chart below, the riskiest bonds to own when rates are rising are long-term treasuries.

And that is exactly what is being disproportionately added to the bond indexes.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us