Global View Investment Blog

Unexpected Early Retirement Due to COVID-19? 7 Ways to ‘Catch-Up’

An early retirement can be a great accomplishment. It can be the result of aggressive savings, strong investing and a solid plan that was followed consistently. However, as a Certified Financial Planner in Greenville, SC, sometimes, we see an early retirement that isn’t voluntary; an unexpected situation that is the result of a difficult job market, an economic recession, family events, or recently, the COVID-19 pandemic.

COVID-19 changed life on a global level. Unfortunately for some, the effects of the pandemic forced them to move their retirement date up sooner rather than later. This can be a scary predicament, especially if you aren’t financially (or emotionally) prepared to make the transition.

But here’s the good news: If you are facing an unexpected early retirement, there are things you can do to play catch up on your savings.

At Global View, our Certified Financial Planners (CFPs) in and around Greenville, SC have seen an increase in these cases post-pandemic and therefore, compiled the following 7 tips that can help you bridge the gap. If you have a question about any of the steps below, or have a concern that is not addressed here, don’t wait to discuss your situation with a financial advisor.

Take Advantage of Catch-Up Contributions

Your retirement accounts are still one of your greatest resources to boost your savings for the future. If you’re facing an early retirement, commit to contributing more to your retirement accounts, especially if you find yourself behind on your savings goals. Work toward the annual contribution limit if you can.

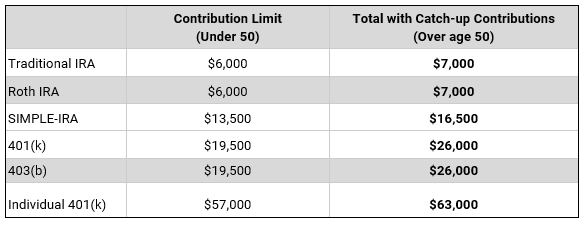

What’s more, retirement accounts have higher contribution limits for individuals age 50 and older, and this added benefit can be your major advantage. If you have a 401(k) for example, those under the age of 50 can only contribute $19,500 per year. However, starting in the year of your 50th birthday, that contribution limit increases to $26,000, a 36 percent increase.

Catch-up contributions can add jet fuel to your retirement savings. The limits are different depending on the type of account you have. Reference the chart below for the catch-up contribution limits for common retirement accounts. If you have an account that is not listed here, talk to a financial advisor about your options.

Pay Off Debt

As a Certified Financial Planner in Greenville, SC, debt is a silent money killer. If left unchecked, your debt can go from a small, manageable balance into a mountain of owed money that is very difficult to pay off. Though credit can be useful when starting a business, buying a home or help you during an emergency, be sure to keep it on very short lease.

“Bad debt” is debt that can be severely damaging to your finances due to high interest rates and minimum payments. One of the biggest bad-debt culprits is credit card debt. If possible, eliminate debts like this first. Then take a look at your mortgage, student loans and other obligations. Will they be paid off before you retire? (Read our recent blog post: Are You a Slave to Your Castle?)

If you’re not sure how to get started, discuss different strategies with a financial advisor.

Take a Second Look at Your Assets

Once you’ve examined your debt more closely, take a look at your assets. As a Certified Financial Planner in Greenville, SC, often times what a client believes to be an asset may actually be a liability. On the flip side, there may be opportunities you may not be aware of.

For example, can you capitalize on the equity of your home? What’s the future of your family business? Are you planning on passing the business to your heirs, or does it make more sense to sell your business, or a portion of it, to generate your own personal windfall? These matters can be complicated, but very effective when done right. Talk to a financial advisor about your options.

Assess Your Risk Tolerance

It’s very important to review your investment strategy as you approach retirement, whether it’s an unexpected early retirement or not. Often times, this is when our risk tolerance will change. During your working years, your goals are likely to grow and generate savings. Once you enter retirement, you’ll eventually start to draw from these accounts.

If you’re facing an early retirement, talk to a financial advisor about the amount of risk you’re taking in your investments and find a balance between generating the returns you need to reach your goals while preserving your retirement income. A Certified Financial Planner can help you effectively articulate your needs as an investor, and understand what it really means to have a strategy that is conservative, aggressive or somewhere in between.

Read our recent blog post: Is It Time to Re-Evaluate Your Risk?

Work Longer

Working longer may also be an option. If your current position is no longer available, think outside the box. Working longer, even in a different role, can help you relieve the financial pressure on your retirement accounts. In fact, working a little longer may have a multiplier effect on your finances.

For example, if you decide to work longer, not only will you continue receiving a salary of some sort, but depending on your employer, you may be able to put extra money in your retirement accounts (think catch-up contributions and maybe even a match), and you could be eligible for healthcare benefits. Healthcare can be expensive in retirement, especially if you don’t yet qualify for Medicare.

Delay Social Security

Social Security is another important component of your retirement plan. Though Social Security benefits aren’t usually enough for one person to live off of alone, they can provide a solid lift to your monthly cashflow. Waiting to take your benefits until later can actually result in higher monthly payments.

Social Security payouts increase every year until you reach age 70. Receiving Social Security at age 62 instead of age 67 can make a big difference.

Read our recent blog post: 3 Reasons You May Want to Claim Social Security Benefits Later.

Talk to a Financial Advisor

Facing an unexpected retirement can be confusing, complicated, terrifying even. Talking to a fiduciary Certified Financial Planner can help you manage the anxiety. Having a professional review your financial plan can provide peace of mind and an outside, objective perspective that can help put things in focus.

If you’re not currently working with a financial advisor or feel it’s time for a second opinion, let’s talk! Global View is a fee-only, fiduciary financial advisory firm headquartered in Greenville, South Carolina that serves investors nationwide. Our mission is to provide truly independent, conflict-free advice and complete wealth management services, so you can protect and maximize the wealth you’ve built.

Written by Adam Wiles

Adam is a Partner at Global View. Adam’s primary focus is on investment strategy, retirement planning, risk management, and new client identification. He has extensive experience and training in identifying client’s needs and explaining the solutions that meet those needs. He worked with Merrill Lynch for 2 years prior to joining Global View. Prior to Merrill Lynch, Adam worked 10 years, in several trading capacities, within the Commodity Lumber business.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us