Global View Investment Blog

Why You Need an Advocate to Weather Market Corrections (and Beat the Financial Services Confusopoly)

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” Peter Lynch

In Brief:

The market is likely in a correction, not a bear market. Corrections happen on average once a year. During corrections, the market falls more than 10% but less than 20%. The average correction is about -13.5% and lasts 14 weeks. Important: Corrections are normal and expected! We have just been spoiled to forget that over the last years!

Corrections (and bear markets) are the most dangerous time for most investors. When investors sell, banks and insurance companies buy. This means investors literally transfer their returns from themselves (or heirs) to the institutions. Which is why I am writing this.

Don’t let anyone you love (or like) become a victim of the financial services confusopoly!

We came prepared for this. We selected investments to work in the current environment. And they are working. Even if it doesn’t look like it when emotions run high. This is an important reason we assessed your risk and invested according to your risk expectations.

Remember (it’s important), volatility (stocks going down) is the price you pay to make more than cash! It’s not avoidable. In this industry there are a lot of shysters telling you to buy a “guarantee” to avoid volatility. This guarantee is essentially a transfer of wealth from you (or your heirs) to them (and their company). Don’t do it! And tell us if your neighbors have been sold that bag of goods! Because it’s the worst thing that can happen to them.

The correction currently underway will likely end sometime soon. But there’s no way to know that. And we must always be prepared. Because I can guarantee you that we will have more of these! And eventually we will have a bear market.

Our goal is to deliver solid returns over reasonable time periods because this increases your odds of reaching the goals you have set. And while we have historically delivered on that goal, we can’t make a false guarantee.

We’re happy to be your advocate by ensuring we understand your risk and are taking the appropriate actions to help you navigate it. And we’re happy to work with your friends and family to make sure they are as well. We’d like to be their advocate too.

More Detail:

Stock Market Corrections are Expected

Recent action in the stock markets has many people asking if this is a bear market, like 2008. The odds are it’s not. Here’s why:

- 10% plus Market corrections happen on average once a year. We tend to forget this, but it’s literally why we focus so much on risk.

- Stock market corrections rarely last long. From 1945 to 2013 the average correction was -13.3% and lasted about 14 weeks. Since 2008 there have been about 8 corrections and no bear markets.

- Bear markets (20% plus) are rare. You probably remember the US bear markets in 2007-2008 and from 2000-2002. There were also bear markets in 1987, 1982, and 1974.

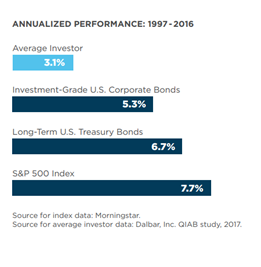

- Investors leave half of their potential returns on the table, as they try to time the market.

There’s no way to know in advance when a correction can turn into a bear market. The future is unknowable, but we can do a lot to manage expectations. Because we know that it’s the unexpected surprises that derail investors. Which means we need to make sure surprises are not unexpected.

This is the reason we are so fervent about assessing your risk. We manage assets to meet your expectations (and avoid negative surprises)!

Remember we want to avoid unexpected downside volatility. Because knowing what to expect is how you make sure it’s no longer unexpected! As your advocate, it’s our job!

What Volatility Should I Expect?

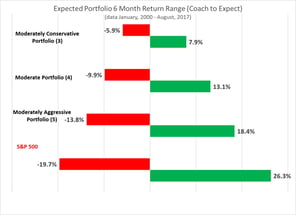

Clients generally fall into one of three risk categories: Moderately Conservative, Moderate or Moderately Aggressive. Investors in each category experience volatility proportional to the risk they take.

Return ranges are for six-month periods. This is what you can expect at a confidence level of 95%. It represents two standard deviations to you engineers or math guys. Moderate investors take half the risk of the market. Moderately-Aggressive 70%, Moderately-Conservative 30%.

Our goal, for all three portfolios, is to build a resilient portfolio. A resilient portfolio bounces back after things get rough. This is in sharp contrast to most funds – remember the fiasco of 2008, when investors were still underwater in 2012? Or worse investors in 2000, who were underwater in 2012. Our goal is to build portfolios that will deliver positive returns over three-year periods (with high odds). We know there may be some periods where we cannot deliver on that goal (it’s no guarantee).

View a webinar on this topic I did in October here: Webinar on Building Portfolios to Snap Back

We add value for investors for the reasons stated above (selecting managers). And because taking a truly global view to investing may add substantial value in the future. While we cannot ever say the future will be like the past, we have historical evidence to believe we can do this going forward. Specifically, if we view “the market” as a global market of stocks and bonds it allows us far more flexibility to find better opportunities in both stocks (of all sizes) and bonds (of public and private companies).

Jean-Marie Eveillard did this from 1979-2004. We hope to replicate this experience as closely as is possible.

What do We Do Now?

We can’t tell you this too many times. Investors owning funds that are closet-indexes of the US stock market may be in for a rude awakening. Unfortunately (and we have seen a lot of this recently) that’s what most investors own in their company 401ks.

Investors invested in these funds may be worried and take the wrong action (sell at the wrong time). Especially if they are in their 60s, thinking about retirement. These investors have probably been very happy up to this correction. But are probably thinking about it now. They may be thinking about what happened during the last major downturns, like in 2008.

Investors who are not our clients, who are close to retirement may be thinking about this, given recent volatility. It’s a great time to re-assess your situation. As a first step we get a valid understanding of your tolerance and capacity to take risk.

Follow this link to access our tool and learn your risk profile: Learn Your Risk Tolerance

Sadly, even if you hold tight (and don’t sell at the wrong time) you must consider other concerns. The stocks in the funds in most 401k plans are most likely overvalued. You might want to know about the forward return potential of these funds (and the US stock market overall).

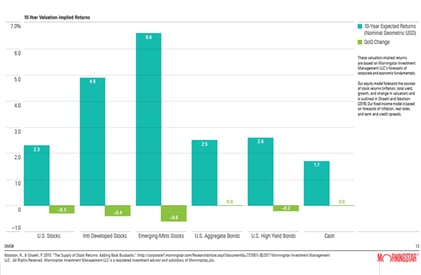

This chart was put together by Morningstar. It suggests return potential is much higher in emerging markets and international stocks than in US stocks. And that expected returns in bonds are also low. This means you need a global perspective for stocks. And you might want to rethink the way you buy bonds.

The managers (and our stock portfolio) are different.

Running a stock portfolio in-house helps us to gain a better understanding of risk. Our portfolio, which we call Great Businesses, buys according to a very strict set of criteria. We screen 2,200 stocks to pick the top 10% we believe offer the most replicable and best risk-adjusted returns in a tax efficient fashion. The portfolio has been offered to clients now for 3 ½ years. During that time, it has rarely had over 20 “buys” (companies we would buy on a given day). Most of the holdings are “holds’ (companies we wouldn’t buy but wouldn’t sell). On February 6, the portfolio had 22 buys. That’s one of the highest ever. Moreover, the portfolio generally trades close to intrinsic value (as assessed by Morningstar stock research). It now trades at a 10% discount.

Running a stock portfolio also helps us to understand they key holdings of our managers. There is a lot of overlap between holdings in the stock portfolio and the US positions of our managers. But because our screen is primarily US-oriented (for many reasons), the global managers own positions in overseas markets we can’t screen or buy.

The fund managers in your portfolio were very carefully selected to avoid losing money that can’t be made back. They have built systems to do this.

For a detailed explanation on how we selected these read this: Responsibly Picking Investment Managers

Again, if you are not a client and have questions, you might want to have a free consultation. Because we are fee-only fiduciaries we only have one bias. It is that we believe you will have more wealth working with us than you would on your own. But we understand you don’t know that yet. For this reason, we have developed a service where we can set your path if you prefer to do it yourself.

We call this Setting the Path. Here’s how it works:

- We set up a no-obligation phone call for 15- 30 minutes to determine if there is a mutual fit.

- We set a meeting to learn your goals and current situation. Between the call and the meeting we give you some homework. We also give you our brochure on Setting the Path, so you know what to expect.

- We have the first meeting. It’s complimentary. At the end of that meeting you agree to pay for a Plan Summary, for which we charge $895. If you don’t see the value in that there is no 0bligation.

If you hire us for Setting the Path, we conduct a second meeting where we give you high level Plan Summary. If that’s all you want, you’re done.

We have found the overwhelming majority of people who hire us for Setting the Path also hire us for ongoing portfolio management. But that’s your choice. And there is no risk! Really. Because we want to educate as many people as we can and help them avoid being confusopoly victims!

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us