Global View Investment Blog

Should I Adjust My Investment Strategy Because of Potential Trade War? Where in the World Should I Invest?

In Short

Investors worry a trade war may disrupt economic growth and cause a market crash. The president means business, especially against China. As warning shots are fired, this impacts emerging markets and value stocks the most. U.S.-based growth stocks seem safe. But these have risen more than their earnings warrant.

We can’t say what will happen in the short run. But we know valuations are the primary driver of returns in the long run. Fear paints global stocks with a broad brush. This causes excellent stocks to fall with the mediocre and not so good. It creates opportunity for enterprising investors. And while U.S. and international stocks generate highly similar returns over the long-run, there has been a disparity again this year.

Because our concern is to avoid losing money that can’t be made back, we focus on making the right long-term bets. This means we aren’t making wholesale changes to portfolio allocations. We know the “easy” path is to own overpriced U.S. growth stocks (like Netflix and some other tech stocks). With the U.S. economy growing nicely, they look safe. But our clients know what happened the last time that seemed easy. The last two times U.S. growth stocks got this far ahead was 2000 and 2007. Those did not end well for owners of those stocks. The experience was better for more discerning investors, who follow the teachings of Jean-Marie Eveillard.

A revisit to this blog might be helpful: Why We Work Hard to Find Excellent Managers.

More Detail

The U.S. and global economies show strength despite concerns about trade war. As economies improve, company earnings get stronger. Rising earnings lead to higher stock prices. But the prices of U.S. growth stocks have risen more than their earnings. And cheaper companies, whose earnings may also be improving, have been left behind.

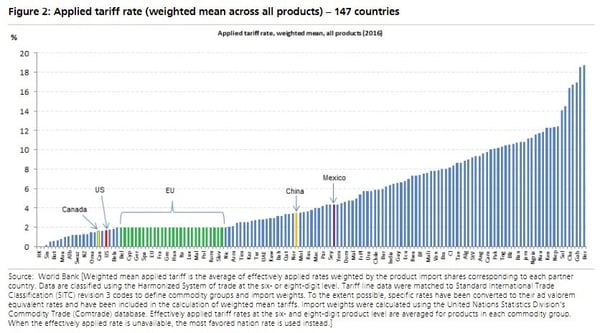

Many investors are concerned that trade war will upset the economy. No one likes tariffs. In an ideal world, trade would be free across borders. It’s not. Tariffs in the European Union are a bit higher than in the U.S. Tariffs in other countries, like China, are much higher.

Countries put up many barriers to trade. Taxes play a role. Government subsidies, especially investment incentives, play a role. Reducing the U.S. corporate tax rate was an essential first step in rectifying this.

The World Bank has warned that an increase in tariffs could cause economic havoc. That’s true. If the overall level of tariffs were to rise, this would hurt the global economy. But if the U.S. is asking for tit-for-tat, then the goal is to reduce the overall level of tariffs. To be credible, threats must be carried out. This is unfortunate, and when it happens, it creates uncertainty.

China is our most important trade partner that is abusing tariffs. The time to address this problem is not when the economy is weak, but when it is strong. Which means right now. Fallout from the spat between the U.S. and Turkey has caused the Turkish Lira to fall. Many other emerging markets’ currencies have moved in sympathy.

During periods of volatility, companies are hit with the same broad brush. It means excellent quality companies in emerging markets are all hit. Companies growing earnings are hit just as poorer state-owned enterprises are.

That said, it seems clear to most observers that the president means business. And this will have an impact. There will be winners and losers. But most of the price movement we are seeing now is unlikely to be permanent. And this means it creates opportunity.

We believe there are more important concerns investors face: Valuations and rising interest rates.

U.S. Stocks are the Most Expensive in the World

Because most investors are invested primarily in the United States, they should know the outlook for stocks and bonds there. And they should know that better opportunities lie outside the U.S.

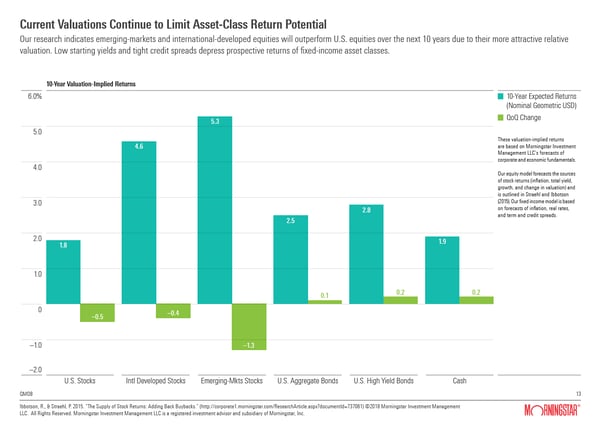

Morningstar does an excellent job researching stocks and bonds (we put this in higher regard than their fund research). They forecast U.S. stocks will make less than 2 percent per year for the next 10 years.

In contrast, international and emerging markets stocks offer returns two to three times higher. The cheap often gets cheaper before waiting pays off. And we all know the price for long-term success is usually short-term pain. It means investors should expect more short-term pain.

Interest Rates Have Been and May Continue to Rise

The U.S. economy is currently growing at about 4 percent after inflation. Most economists agree this is higher than the “natural rate.” When the economy grows more than the “natural rate,” it puts higher pressure on wages and other costs. This means interest rates rise. While it looks like a lot of investors missed this, it’s because they weren’t paying attention. Tax cuts freed up a lot of consumer spending and are the impetus behind this growth.

As real interest rates rise, this puts downward pressure on stock prices. It also causes safer bonds (like U.S. treasuries) to fall in price. Observers of the last period of extended rising rates (the 1970s) know what happened then. As rates rose, the U.S. stock market barely kept up with inflation for more than a decade. During that period, Warren Buffet (and his SuperInvestors) made about 12 percent per year, after inflation.

SuperInvestors of Graham & Doddsville

To be clear, this is not a prediction. Instead, it is an assertion that active portfolio management may become increasingly important.

Charles de Vaulx, portfolio manager at International Value Advisors, believes rates will rise more. Loose monetary policy, tight labor markets and wage pressure lead to higher rates. Read Charles’ Interview here: How to Stay Rich featuring Charles deVaulx, Portfolio Manager of IVA funds.

Putting it all together

Because they generally have something to sell, I am skeptical when reading Wall Street Pundits. I prefer looking at data. The data shows that earnings, broadly, globally, continue to improve. The U.S. economy has led. Astute observers can see the rest of the world has room to catch up.

The easiest thing for many investors to do is what they have been doing. It’s to continue investing in U.S. stocks and bonds. That is short-sighted and ignores fundamentals. U.S. stocks are expensive and “safe bonds” are likely to keep losing money. But that is exactly what index investors, like at Vanguard, are doing.

As we have shown time after time, this is ridiculously risky. On the equity side, investors in indexes would have endured 12 years of losses (2000-2012) in the large index funds. We caution clients to avoid the pitches many “investment consultants” are making to prospective clients. Anyone can tell you how much you would have made if you invested on this date until that date, in these investments based on how we know they did. Because hindsight is 20/20.

Don’t get me started on bond indexes. Investors in bond indexes (like at Vanguard) aren’t even trying to make reasonable returns. Remember, more than half of the money in bond market is not invested with a pecuniary motive. In other words, more than half of bond investors are not investing to make money!

For this reason, we have a disciplined system. And this system relies on a global perspective. The experience of Jean-Marie Eveillard is the lesson of a possible better outcome. Jean-Marie lagged the U.S. stock index in the late 1990s, losing half of his clients. Those clients later regretted that decision. His performance from 2000-2003 was more than 10 percent per year, when many indexes dropped in half.

His lesson is that risk can be reduced and return potential enhanced by employing a global perspective. This is literally where our name, Global View, came from.

By broadening our reach across company size and geography, we strive to avoid this catastrophe. Our investment thesis is to find the best companies anywhere. The best companies have the best combination of quality, earnings growth and valuation. Recently, the market has over-rewarded earnings and under-rewarded valuation.

We take the path proven to be historically right, even when it appears difficult. Due to trade war concerns, emerging markets have become much cheaper. This means the emerging markets positions our managers hold have become cheaper as well. Rondure Global, which has a joint venture with Grandeur Peak, is one of the hardest hit. We hired Rondure, after interviewing Laura Geritz, who aspires to implement Jean-Marie’s teachings.

Of note, this has even caused the Grandeur Peak funds, most of which have demonstrated about half the downside risk of their peers over three-year or more periods, to suffer. Of the equity Charles de Vaulx manages in the Worldwide fund, 58 percent is outside the U.S. Similarly, the managers at Grandeur Peak typically have more than 60 percent invested outside the U.S. It’s because they see more opportunity there.

We do all of this because we have a simple goal. We want our clients to avoid losing money that can’t be made back. And because we want to maximize the odds of our clients achieving the goals they have set with us.

We welcome further conversation. Reach out anytime.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us